Discover the most advanced trading algorithm powered by the Imperium Quant Stack™

More Profits. Less Screen Time. Less Stress.

Multi-Strategy Matrix (20+ algorithms): Never bet on one approach

Automated execution: No manual trading, no chart watching

Built-In Risk Control: Manages drawdowns automatically

Capital Stays With You: Runs in your own MT4/MT5 account

Minimal time commitment: Set up once, then hands-off

Most Trading Systems Fail for the Same Reason

The market changes faster than static strategies can adapt...

That's why you've probably experienced:

Bots that work for weeks, then collapse

Manual strategies that fail during volatility

Signal groups with no risk management

Constant stress and inconsistent results

The pattern is always the same: great performance... until conditions shift.

The Imperium Quant Stack™

Three Layers of AI That Adapt In Real Time

Instead of one strategy that eventually breaks, Imperium FX Pro runs 20+ algorithms simultaneously and automatically shifts to whatever's working now.

Here's how it stays consistent:

01 - Scoring+ Framework

Identifies What's Working Right Now

Continuously evaluates 30+ metrics across all algorithms to identify which strategies are performing best in current market conditions.

02 - NSGA-II Optimization

Builds the Optimal Portfolio

Genetic algorithms build optimal portfolios that maximize profits while minimizing correlation, solving complex problems manual allocation can't.

03 - XGBoost Risk Engine

Protects Your Capital

Machine learning predicts underperformance and shifts allocations in real-time to protect your account during market regime changes.

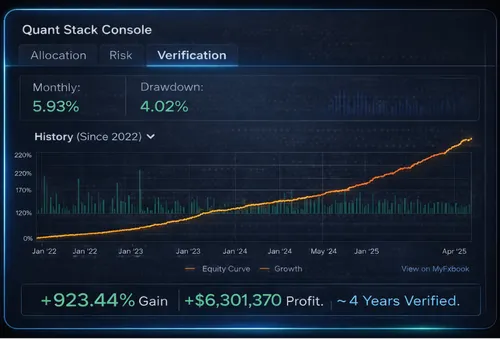

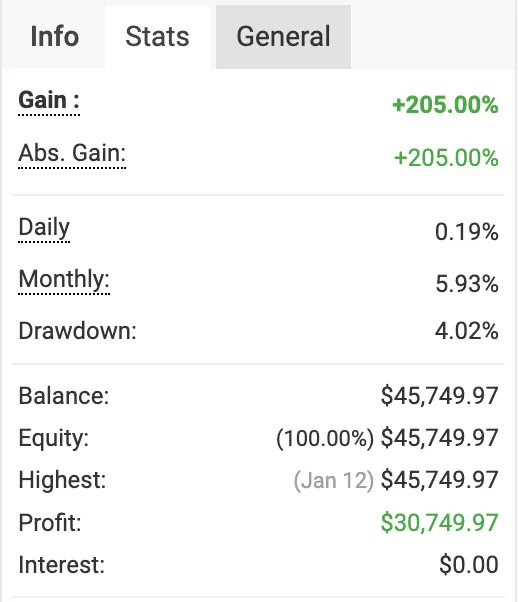

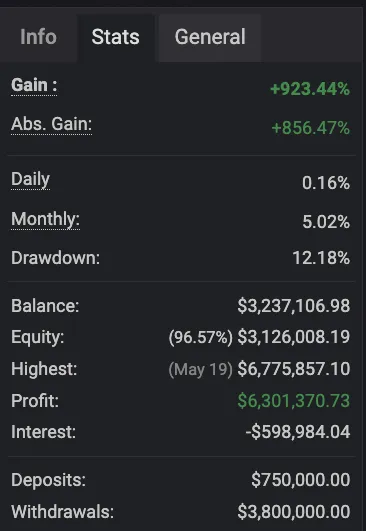

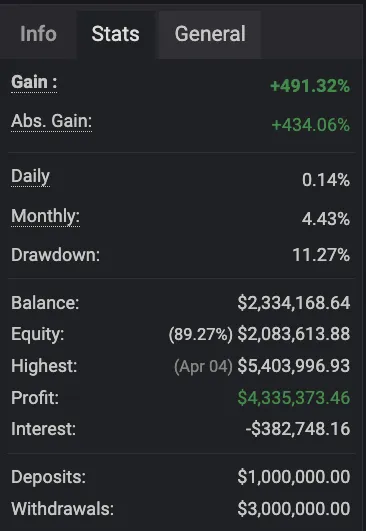

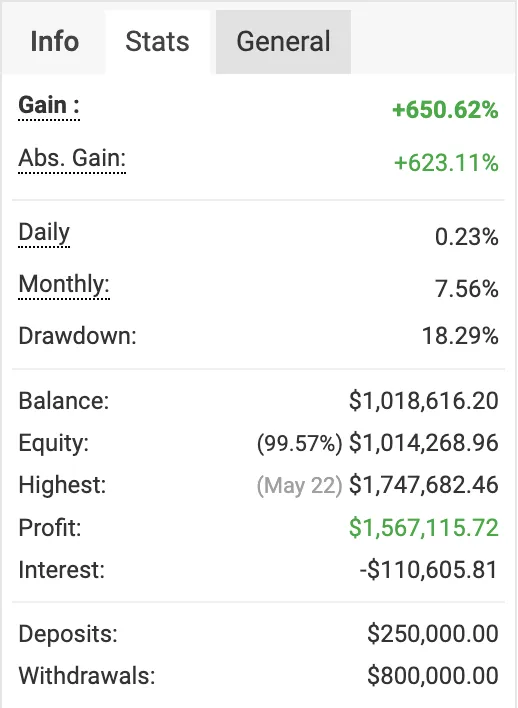

Verified Results

This System Is For You If:

You have $10,000+ to allocate

You want systematic, hands-free trading

You value transparency (MyFxBook verified)

You prefer diversification over single-strategy risk

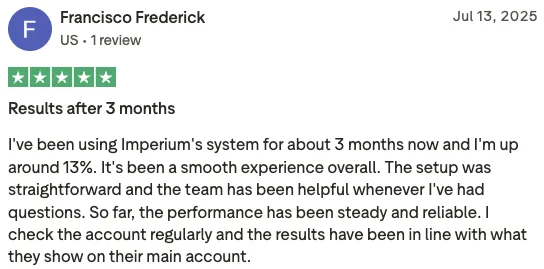

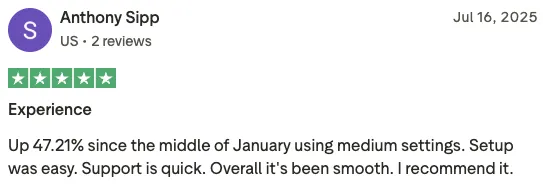

What Our Clients Say

F.A.Q

Does this actually work, or is it just another bot that'll blow my account?

Imperium runs 20+ algorithms simultaneously rather than relying on one approach that eventually fails. When one strategy slows down, others step in. Any market-based system carries risk. Imperium systems are designed to limit drawdowns, control exposure, and prioritize capital preservation over aggressive growth.

Risk levels are adjustable, and no single strategy can dominate the portfolio.

Are these real results or demos/backtests?

All performance shown is live, real-money trading and third-party verified. We do not use demo accounts, hypothetical backtests, or optimized simulations as marketing proof. If performance can’t be independently verified, we don’t show it.

Where is my capital held?

Your funds remain in your own brokerage account, and you can deposit or withdraw capital whenever you choose, subject only to the broker’s standard processing times. Imperium operates as a technology provider that executes trades through your MetaTrader platform, we never custody client capital.

Do I need to monitor this 24/7, or is it truly hands-free?

You do not need to monitor charts or manage trades manually. Once set up, the system executes automatically based on predefined quantitative rules. You can check performance, view trades, or adjust risk settings at any time, but there is no requirement to actively manage positions.

What happens when market conditions change?

Most trading systems fail because they rely on one strategy. The Imperium Quant Stack™ is matrix-based, allocating across multiple independent quantitative strategies designed for different market regimes.

When conditions change, allocation changes, instead of relying on a single model to “come back.”

If this actually works, why are you selling it?

Imperium is a technology provider, not a hedge fund. Clients run the systems in their own brokerage accounts, maintain full capital control, and choose their own risk parameters. Scaling software infrastructure is fundamentally different from scaling capital.

Why can’t I use U.S. brokers? Is this legal?

Yes, it’s legal. U.S. brokers operate under FIFO (First In, First Out) and no-hedging regulations, which conflict with how multi-position, portfolio-based trading systems function.

Non-U.S. brokers allow:

- Multiple positions per pair

- More precise risk and exposure management

- Proper execution of portfolio strategies

This is a regulatory limitation, not a legality issue. Many institutional and professional trading systems operate under the same constraints.

How much capital do I need to start?

Minimum capital requirements depend on:

- The system selected

- Your chosen risk level

- Broker margin requirements

Most clients start with $10,000, but higher balances allow for:

- Smoother execution across 20+ strategies

- Lower relative drawdowns (better risk management)

- More effective portfolio diversification

During the live demo, we help determine a setup that aligns with your capital and risk tolerance.

Note: License costs are separate from trading capital.

Do you offer a trial or money-back guarantee?

We do not offer free trials. Instead, we offer a written 60-day refund policy, provided setup requirements are met. This allows clients to see the system running live in their own account without committing long-term capital risk.

Details are reviewed clearly during onboarding, no hidden conditions, no ambiguity.

Schedule a demo call to see live performance data, walk through the system, and determine if you're a good fit.

Copyright © 2026. All rights reserved. Imperium Fx Pro

This website is not affiliated with, endorsed by, or sponsored by Facebook, Google, Snapchat, TikTok, Twitter, or any other social media platform.

Imperium Fx Pro provides software and technology tools designed to assist users in analyzing, monitoring, and executing their own trading or investment-related decisions. We do not provide financial, investment, tax, or legal advice, and we are not a broker, dealer, or fiduciary. Use of the software involves risk. Market conditions, pricing, liquidity, and other external factors may impact results, and losses can occur. Users are solely responsible for how they use the software and for any decisions made based on information generated by it. All information made available through this website or the software is provided for educational and informational purposes only and should not be interpreted as a recommendation, solicitation, or endorsement of any specific trading or investment activity. Past performance, whether generated by the software or referenced in examples, does not guarantee future results.